Alexandre Laurin of the Economics Division of the Canadian Parliamentary Information and Research Service in February 2006 reported the following:

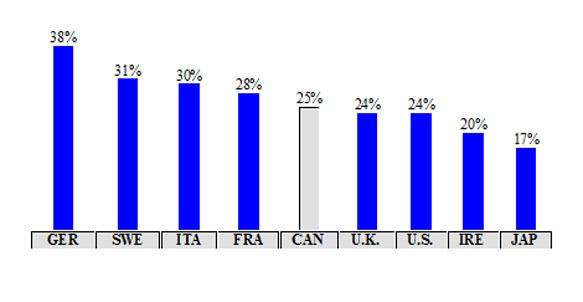

Average Tax Rate on Employment Income, Various Countries, 2004

Single Individuals Without Children with Income of $40,000:

Click on the chart below to see an enlarged, clearer chart.

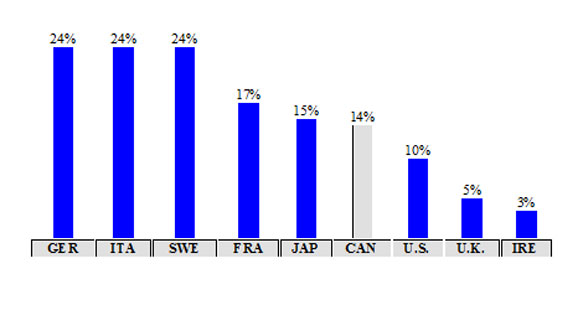

Average Tax Rates on Employment Income, Various Countries, 2004

Single Parent with 2 Children and an Income of $40,000:

Click on the chart below to see an enlarged, clearer chart.

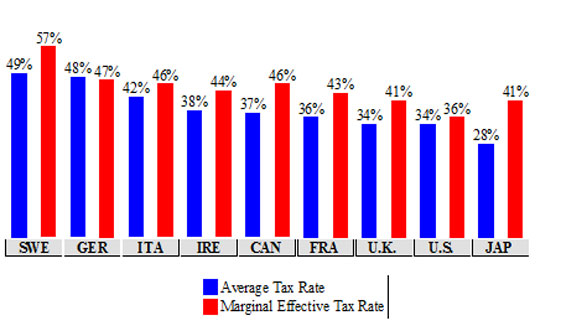

Average Tax Rate and Marginal Effective Tax Rate

on Employment Income, 2004

Single Individual Without Children with Income of $150,000:

Click on the chart below to see an enlarged, clearer chart.

To read the entire report, click on International Tax Burdens: Single Individuals With or Without Children.