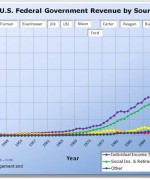

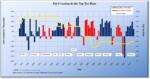

truthful politics reviewed jobs statistics provided by the United States Bureau of Labor Statistics and the top tax rate provided by the Tax Policy Center and the Tax Foundation. The Bureau of Labor Statistics provides the official numbers on jobs gained or lost for the U.S. The chart below shows how many jobs annually were […Full Article]