Robert Gordon and Ian Dew-Becker in May 2008 wrote the following about economic inequality in the United States:

- Between 1979 and 2005, the income gap for women between the 50th percentile and the bottom 10th percentile grew more than for men at the same income levels for the same time period.

- Between 1973 and 2001, the decline in unions explains 14% of the increase in income inequality amongst male wages.

- Between 1980 and 2000, the life expectancy of the bottom 10% of earners increased at only half the rate of the top 10%. “This may be the most important single source of the increase in inequality in the United States, and it combines not only unequal access to medical care services and insurance, but also to differences in personal habits and environment related to education and income.”

- In 1993-1995, the top 5 corporate officers earned compensation equal to 5% of their firms total profits. In 2000-2002, the ratio increased to 12.8%.

- “Why the disparity? America’s CEOs have had their pay inflated by generous stock options and having their pay set by peers on corporate boards, the survey finds, as well as institutional differences between the United States and other nations, including such things as regulations, unions, and social norms.”

To read the entire article, click on The Causes of Rising Income Inequality.

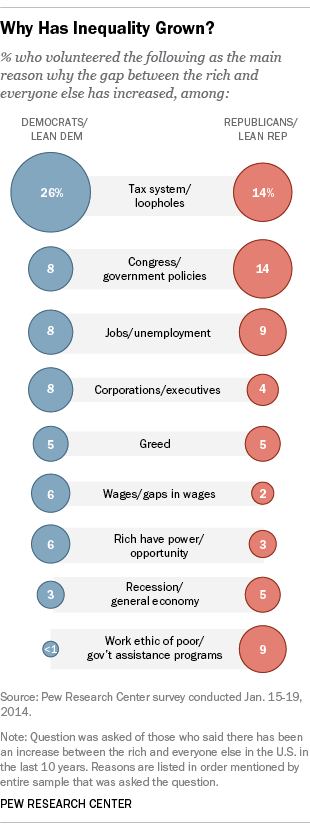

To read the entire article, click on Americans agree inequality has grown, but don’t agree on why.

Anne Bradley wrote the following:

- One measure of income inequality is the Gini coefficient. The higher the Gini coefficient, the higher the income inequality. A Gini coefficient of 0 indicates perfect equality where everyone earns the same income, and a Gini coefficient of 1 indicates perfect inequality where one person holds all the income and everyone else has no income.

- “The United States Gini coefficient in 1967 was .399 and in 2001 it was recorded at .466.”

- The six causes of income inequality are family structure, technology, growing markets, immigration, property rights, and income mobility.

- Changes in U.S. tax rules caused a shift from corporate to individual tax reporting. This shift accounts for more than half of the increase in the top 1%’s income share since 1986.

- The increasing use by middle-income earners of tax-sheltered investments inside 401(k)s, IRAs, etc. makes it look like middle-income earners have less than in reality.

- Transfer payments, such as Social Security, welfare, and farm subsidies do not show up in income, thus causing no change in income inequality. If the transfer payments were included, income inequality would be less.

- “The Congressional Budget Office (CBO) reports that from 1979 to 2007 real (inflation-adjusted) average household income grew by 62 percent.”

To read the entire article, click on Why Does Income Inequality Exist?

“The Economist” in September 2013 wrote the following:

- 95% of the growth in income from the economic recovery have gone to the richest 1% of people.

- “The gap in test scores between rich and poor children is 30-40% wider than it was 25 years ago”.

- Two causes for the gap between the rich and poor are fast technological change and rapid economic globalization, which have a likelihood to continue.

- Three solutions for reducing income inequality are tax reform, deregulation, and early education.

- Tax reform would include creating a simpler, flatter tax code with no exemptions to make the tax system more efficient while maintaining progressivity.

- Early education would include universal pre-school. “According to the OECD, it ranks only 28th out of 38 leading economies in the proportion of four-year-olds in education.”

To read the entire article, click on Growing apart.

Julia Trello in Finances Online wrote the following:

- In the past 30 years, income for the richest 1% in the U.S. increased by 275%.

- In the past 30 years, income for the poor grew by 20%.

The solutions to income inequality are:

- Improve the legal framework to prevent abuses.

- Ensure that young people have access to food, education, and health care.

- Improve the tax system.

- Higher taxes for the upper-middle class and up.

- Limit tax breaks, subsidies, and loopholes to major energy, agri-business, pharmaceutical, and financial companies.

- Updating tax rates for corporations and individuals whose income is derived from investments.

- Taking power to create credit away from banks.

- Creating alternative methods of distributing purchasing power from wages, salaries, and dividends.

To read the entire article, click on Income Inequality: Views & Solutions From Experts.

In the documentary “Inequality for All,” the following solutions for income inequality were recommended:

- “Raise the minimum wage and/or require employers to pay a living wage and enlarge the earned income tax credit.”

- “Support efforts to unionize workers.”

- Increase state support for public universities so tuition is reduced to the levels of the 1950s and 1960s (typically $0 – $500 per semester).

- “Provide early childhood education and ensure that all K-12 schools offer world-class educations regardless of their students’ family incomes.”

- “Cap executive pay and resurrect the Glass-Steagall Act.”

- “Institute the so-called ‘Buffett Rule’ so that those who earn over $1 million annually (even from capital gains) pay at least the same tax rate as middle class families.”

- “Enact campaign finance reforms that would place caps on campaign donation amounts and disallow corporations to take tax deductions for the cost of lobbyists.”

To view the documentary and read additional information, click on Inequality for All.

Sorry, the comment form is closed at this time.