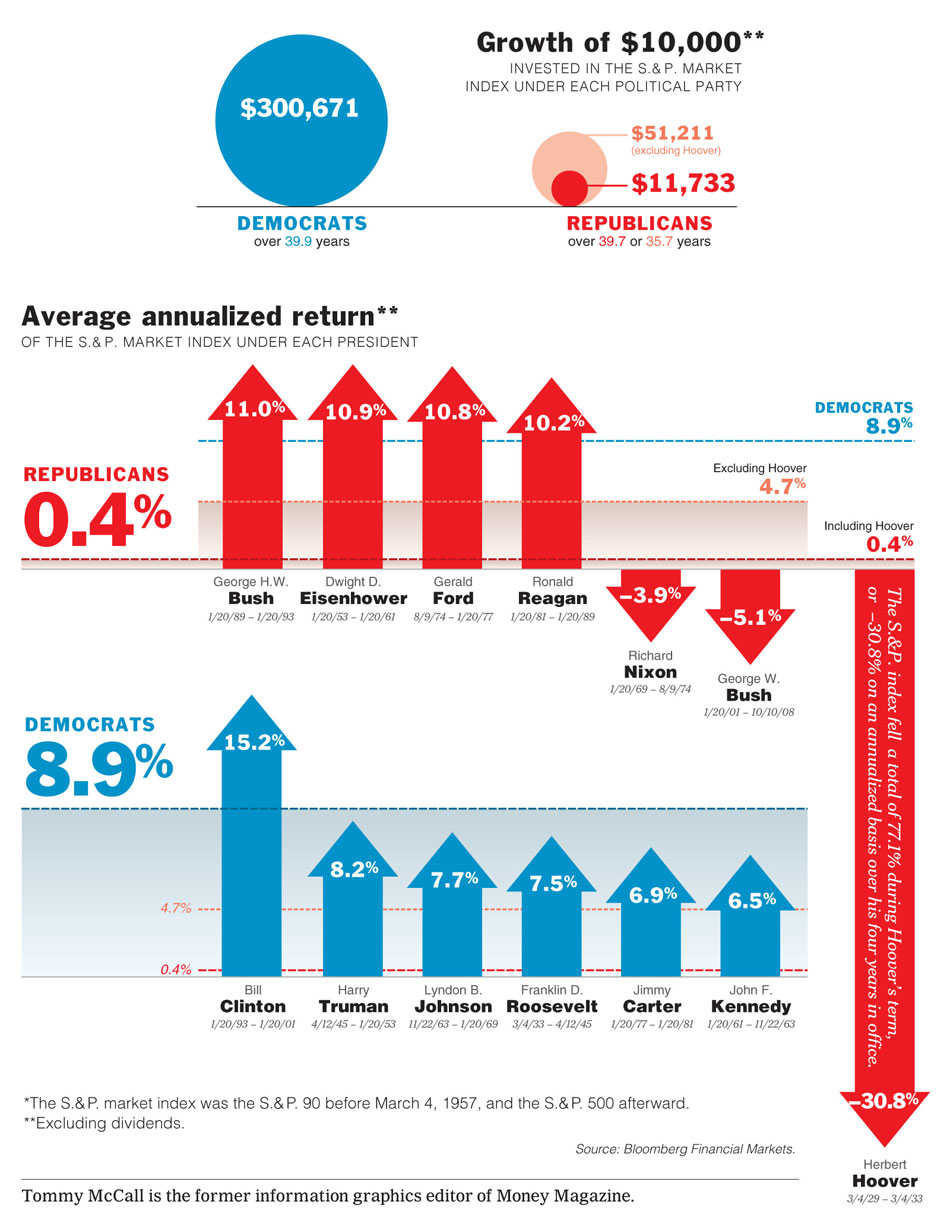

Click on the chart below to see an enlarged, clearer chart.

To read the entire article, click on Bulls, Bears, Donkeys and Elephants.

Bryan Keller in Seeking Alpha in June 2008 wrote the following:

“Additionally, though the analysis done in this paper may have come to the conclusion that historically incoming Democratic Presidents have been good for the stock market, in no way can that be extrapolated to mean that we think they will continue to be in the future. There are many, many other underlying currents out there both positive and negative that will have greater impacts on the stock market then will the election of a figure head (Republican or Democrat) to an office that often times is more ceremonial than substantive to the daily grind of the economy.”

To read the full article, click on Political Party Power and Its Affect on U.S. Market Return.

Jeremy Siegel discusses a similar point:

“And historically, the initial reaction of the market to a Republican presidential victory confirms this thesis. During the last 120 years, the Dow Jones Industrial Average rose 0.7% on the day following a Republican victory in the presidential elections while it has fallen 0.5% the day after a Democrat captured the White House[.] However, a closer look tells a far different story. Over that same 120 year period, the average annual stock market return has totaled only 8.25% under Republican rule, while it has returned 10.85% with Democrats in power.”

To read the full article, click on Which Party Is Better for Stocks?

Lisa Smith says:

“The results of the study, while intriguing, remain inconclusive. While the numbers are certainly real, the correlation may be spurious. In their own words, the authors acknowledge that “it might just be the case that we have stumbled upon a variable that tests significantly even when there is actually no underlying relation between the presidency and the stock market.”

To read the full article, click on For Higher Stock Returns, Vote Republican Or Democrat?

A couple of websites keep on referencing this article:

- The Presidential Puzzle: Political Cycles and the Stock Market

- Pedro Santa-Clara and Rossen Valkanov

- The Journal of Finance, Vol. 58, No. 5 (Oct., 2003), pp. 1841-1872 (article consists of 32 pages)

- Published by: Blackwell Publishing for the American Finance Association

Following is the abstract from JSTOR:

“The excess return in the stock market is higher under Democratic than Republican presidencies: 9 percent for the value-weighted and 16 percent for the equal-weighted portfolio. The difference comes from higher real stock returns and lower real interest rates, is statistically significant, and is robust in sub-samples. The difference in returns is not explained by business-cycle variables related to expected returns, and is not concentrated around election dates. There is no difference in the riskiness of the stock market across presidencies that could justify a risk premium. The difference in returns through the political cycle is therefore a puzzle.”

The rest of the article may be accessed by clicking on The Presidential Puzzle: Political Cycles and the Stock Market.

Sorry, the comment form is closed at this time.