John Madison, the fourth President of the United States, said this in Memorial and Remonstrance:

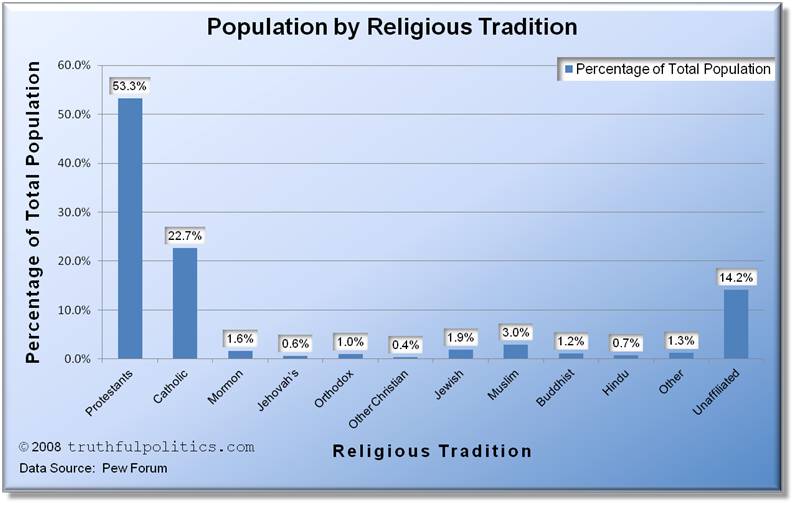

“The establishment of the chaplainship to Congs is a palpable violation of equal rights, as well as of Constitutional principles: The tenets of the chaplains elected [by the majority shut the door of worship agst the members whose creeds & consciences forbid a participation in that of the majority. To say nothing of other sects, this is the case with that of Roman Catholics & Quakers who have always had members in one or both of the Legislative branches. Could a Catholic clergyman ever hope to be appointed a Chaplain! To say that his religious principles are obnoxious or that his sect is small, is to lift the evil at once and exhibit in its naked deformity the doctrine that religious truth is to be tested by numbers or that the major sects have a tight to govern the minor.”

He also said:

“In the course of the opposition to the bill in the House of Delegates, which was warm & strenuous from some of the minority, an experiment was made on the reverence entertained for the name & sanctity of the Saviour, by proposing to insert the words “Jesus Christ” after the words “our lord” in the preamble, the object of which would have been, to imply a restriction of the liberty defined in the Bill, to those professing his religion only. The amendment was discussed, and rejected by a vote of agst.”

In a Veto in 1811, James Madison also said:

“The appropriation of funds of the United States for the use and support of religious societies, [is] contrary to the article of the Constitution which declares that ‘Congress shall make no law respecting a religious establishment’.”

Thomas Paine, an author, in his book, The Age of Reason said:

“All national institutions of churches, whether Jewish, Christian or Turkish [Muslim], appear to me no other than human inventions, set up to terrify and enslave mankind, and monopolize power and profit.”

Abraham Lincoln [not a Founding Father] said:

“When the Know-Nothings get control, it will read: ‘All men are created equal except negroes, foreigners and Catholics.’ When it comes to this I should prefer immigrating to some country where they make no pretence of loving liberty–to Russia, for instance, where despotism can be taken pure, and without the base alloy of hypocrisy.”

Additional quotes may be found by clicking on This link is currently unavailable.

According to EadsHome Ministries:

- John Adams and John Hancock said “we Recognize No Sovereign but God, and no King but Jesus!”

- John Adams in a letter written to Abigail on the day the Declaration was approved by Congress said “the general principles upon which the Fathers achieved independence were the general principals of Christianity”

- John Adams said December 25, 1813 in a letter to Thomas Jefferson “I have examined all religions, as well as my narrow sphere, my straightened means, and my busy life, would allow; and the result is that the Bible is the best Book in the world. It contains more philosophy than all the libraries I have seen.”

- Benjamin Franklin said at the Constitutional Convention, Thursday June 28, 1787, “in the beginning of the contest with Britain, when we were sensible of danger, we had daily prayers in this room for Divine protection. Our prayers, Sir, were heard, and they were graciously answered… do we imagine we no longer need His assistance?”

- Alexander Hamilton in 1787 after the Constitutional Convention said “For my own part, I sincerely esteem it [the Constitution] a system which without the finger of God, never could have been suggested and agreed upon by such a diversity of interests.”

- Thomas Jefferson said “I am a real Christian, that is to say, a disciple of the doctrines of Jesus.”

- George Washington said “it is impossible to rightly govern the world without God and Bible.”

Further quotes from the Founding Fathers can be found on the EadsHome website by clicking on Founding Fathers Quotes.

Archiving Early America has an article describing some of the Founding Father’s views on religion and government:

Thomas Jefferson, “in a letter to Peter Carr, 10 August 1787, he wrote, ‘Question with boldness even the existence of a god.'”

“Called the father of the Constitution, Madison had no conventional sense of Christianity. In 1785, Madison wrote in his Memorial and Remonstrance against Religious Assessments:”

‘During almost fifteen centuries has the legal establishment of Christianity been on trial. What have been its fruits? More or less in all places, pride and indolence in the Clergy, ignorance and servility in the laity; in both, superstition, bigotry and persecution.’

The entire article can be found by clicking Little-Known U.S. Document Signed by President Adams Proclaims America’s Government Is Secular.